Bybit Faces Massive $1.4 Billion Hack: Why This Matters for Crypto Security

Bybit, one of the world’s top cryptocurrency exchanges, recently fell victim to a massive security breach. Hackers drained over $1.4 billion worth of crypto from the platform, raising serious concerns about security in the industry.

What Happened?

On Friday, a hacker targeted Bybit’s cold wallet, specifically one holding Ether (ETH). The attacker moved all the funds to an unknown wallet, according to Bybit CEO Ben Zhou, who shared the news on X (formerly Twitter). Despite the loss, Zhou reassured users that Bybit remains financially stable and that customer withdrawals continue without issues.

Blockchain analytics firm Nansen reported that the hacker stole 401,347 Ether, along with 90,376 stETH, 15,000 cmETH, and 8,000 mETH—bringing the total loss to over $1.4 billion. The stolen assets were first moved to a single wallet and later spread across 40 different addresses.

Is Bybit Still Secure?

Zhou confirmed that all client funds remain secure and are backed 1:1, meaning users will not experience financial losses due to the hack. However, this attack highlights growing vulnerabilities in the crypto industry, especially as security threats continue to rise.

Crypto Hacks Are on the Rise

Bybit’s hack is just one of many in the crypto world. In 2024 alone, hackers stole $2.2 billion from crypto exchanges, a 21% increase compared to the previous year, according to blockchain security firm Chainalysis. Over the past decade, the industry has seen more than $1 billion stolen in at least five different years.

Market Reaction

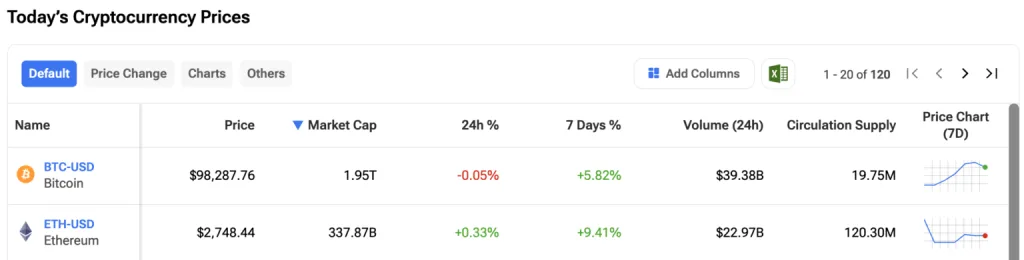

Following the attack, Bitcoin (BTC) and Ether (ETH) experienced slight price drops. Bitcoin fell by 1.4% to around $96,986, while Ether dropped 1.9% to $2,675. These fluctuations highlight how security incidents can impact investor confidence.

What This Means for the Crypto Industry

The Bybit hack serves as another reminder of the risks involved in digital assets. Despite advancements in blockchain security, hackers continue to find ways to exploit vulnerabilities. This incident may push crypto exchanges to invest more in cybersecurity and risk management to protect user funds.

Bybit remains operational and solvent, but this breach reinforces the need for stronger security measures in the crypto world. As cyber threats grow, users and platforms alike must stay vigilant to safeguard their investments.

Stay updated on the latest crypto news and security developments by following Bybit and industry experts.